Abstract

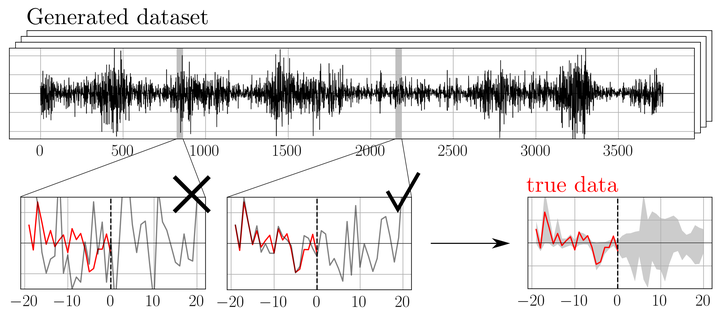

We introduce a Path Shadowing Monte-Carlo method, which provides prediction of future paths, given any generative model. At any given date, it averages future quantities over generated price paths whose past history matches, or shadows, the actual (observed) history. We test our approach using paths generated from a maximum entropy model of financial prices, based on a recently proposed multi-scale analogue of the standard skewness and kurtosis called Scattering Spectra. This model promotes diversity of generated paths while reproducing the main statistical properties of financial prices, including stylized facts on volatility roughness. Our method yields state-of-the-art predictions for future realized volatility and allows one to determine conditional option smiles for the S&P500 that outperform both the current version of the Path-Dependent Volatility model and the option market itself.